Prices of Life

mission statement —

Made for young adults, Prices of Life aims to demonstrate the difficulties of living on your own on a $15 hourly wage without any assistance. This game is intended to demonstrate the disadvantages of living paycheck to paycheck and under lowered standards of living.

Made for young adults, Prices of Life aims to demonstrate the difficulties of living on your own on a $15 hourly wage without any assistance. This game is intended to demonstrate the disadvantages of living paycheck to paycheck and under lowered standards of living.

brief —

create a form of media that explains, demonstrates, or communicates an idea or piece of information.

Completed in June 2020.

create a form of media that explains, demonstrates, or communicates an idea or piece of information.

Completed in June 2020.

my roles —

designer, mathematician, game show host

the goal —

Survive on a $15 minimum wage, it’s that simple! Or is it? You’ve recently graduated and landed your first job. It’s time to move out. Without financial help from family, friends, or loans, can you survive on your own?

Some things in life are necessities, some are optional, and some are emergencies we just never see coming. This game is intended to demonstrate the disadvantages of living paycheck to paycheck and under lowered standards of living.

The game places the player at the beginning of a new job, living on their own. Their bi-weekly pay and benefits are established at the start of the game and players will not get outside financial help from family, friends, or loans.

Players get to choose how to spend their paychecks. Expenses such as rent, utilities, transportation, groceries, leisure, and entertainment are all various checkpoints in the game.

challenges —

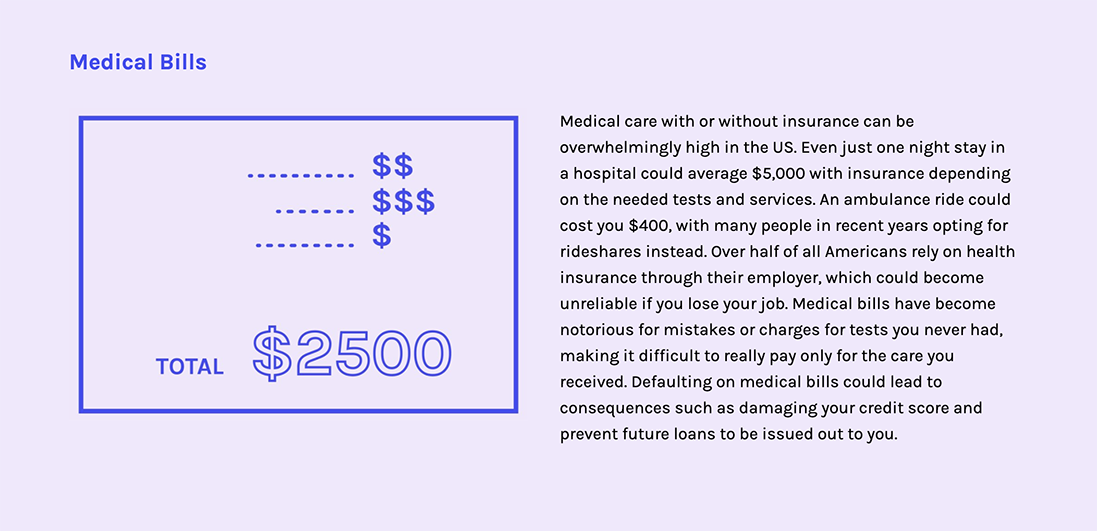

Life is full of risk, and sometimes not the good kind. The player could potentially encounter family emergencies, medical expenses, and other hardships that commonly set people back financially.

![]()

process ︎︎︎

spoilers included*minimum wage —

The lowest wage an employer may offer to workers, set by the federal, state, and local government. The current federal minimum wage is $7.25.

The lowest wage an employer may offer to workers, set by the federal, state, and local government. The current federal minimum wage is $7.25.

living wage —

The minimum income necessary for an individual to cover basic needs in their area. A minimum wage is NOT a living wage.

The minimum income necessary for an individual to cover basic needs in their area. A minimum wage is NOT a living wage.

why $15? —

While the living wage and minimum wage varies state by state, many states have proposed gradually raising the minimum wage to $15/hour, with some states like Washington already starting the climb. San Francisco, CA had this wage implemented back in 2018, with annual increases based on the Consumer Price Index in the city, bringing the city’s minimum wage to $16.32 in July 2021. Critics of the wage hike say it would increase unemployment and harm small businesses the most. Though $15/hour is higher than the livable wage in many states, it was chosen for this activity to demonstrate all the possibilities with such a large sum of money (;

research —

I conducted small interviews with recent graduates and soon-to-be graduates to get a sense of their struggles, worries, and backgrounds. Some of the stories from recent graduates were actually used for the game to include more realistic and real-life scenarios such as the accident that may occur to some players, or the emergency that players may encounter in the game.

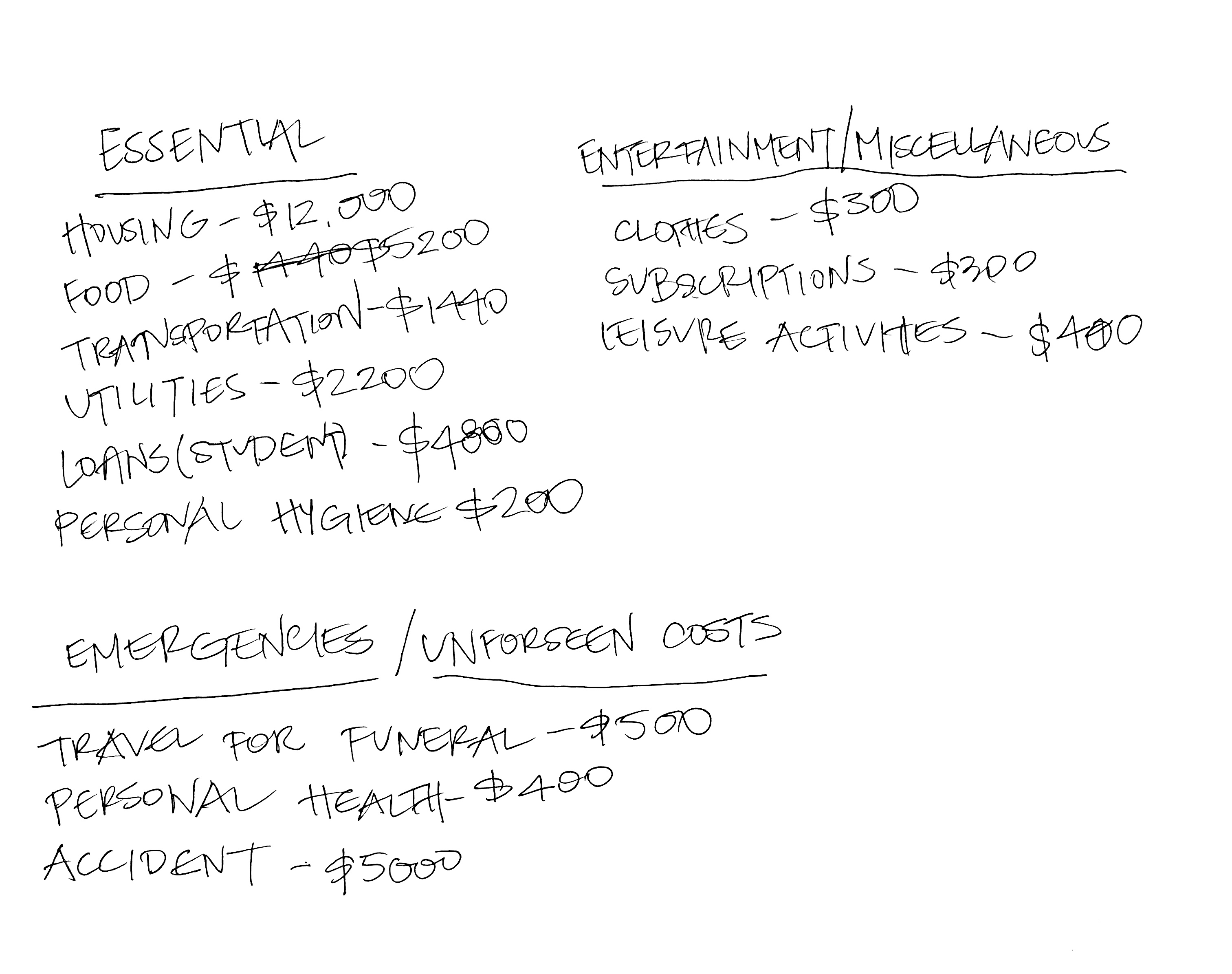

facts and figures — The location the game takes place in is unnamed and it’s cost of living is established based on the average in the US, noting that some areas of the US have lower costs of living and some higher.

- The USDA found that the average weekly bill for groceries

for singles ranged from $40-$75.

-

The average bill for water, electricity, and trash for 1

person living in a one bedroom apartment can range anywhere between $75-$100. Phone, data, and Internet an

additional $50-$100.

-

The average cost of a one bedroom apartment in the

United States is approximately $1150.

-

Public transportation averages $100 per month.

- The average monthly student loan repayment is about $400.

appprox. 1 year of expenses

The prices set in the game either reflect the national average, or are a bit less than the national average, I wanted to give players the advantage. On pages where players had an expense, a link would be at the bottom of the page that would direct the user to the research and justification for the pricing.

![]()

![]()

![]()

![]()

![]()

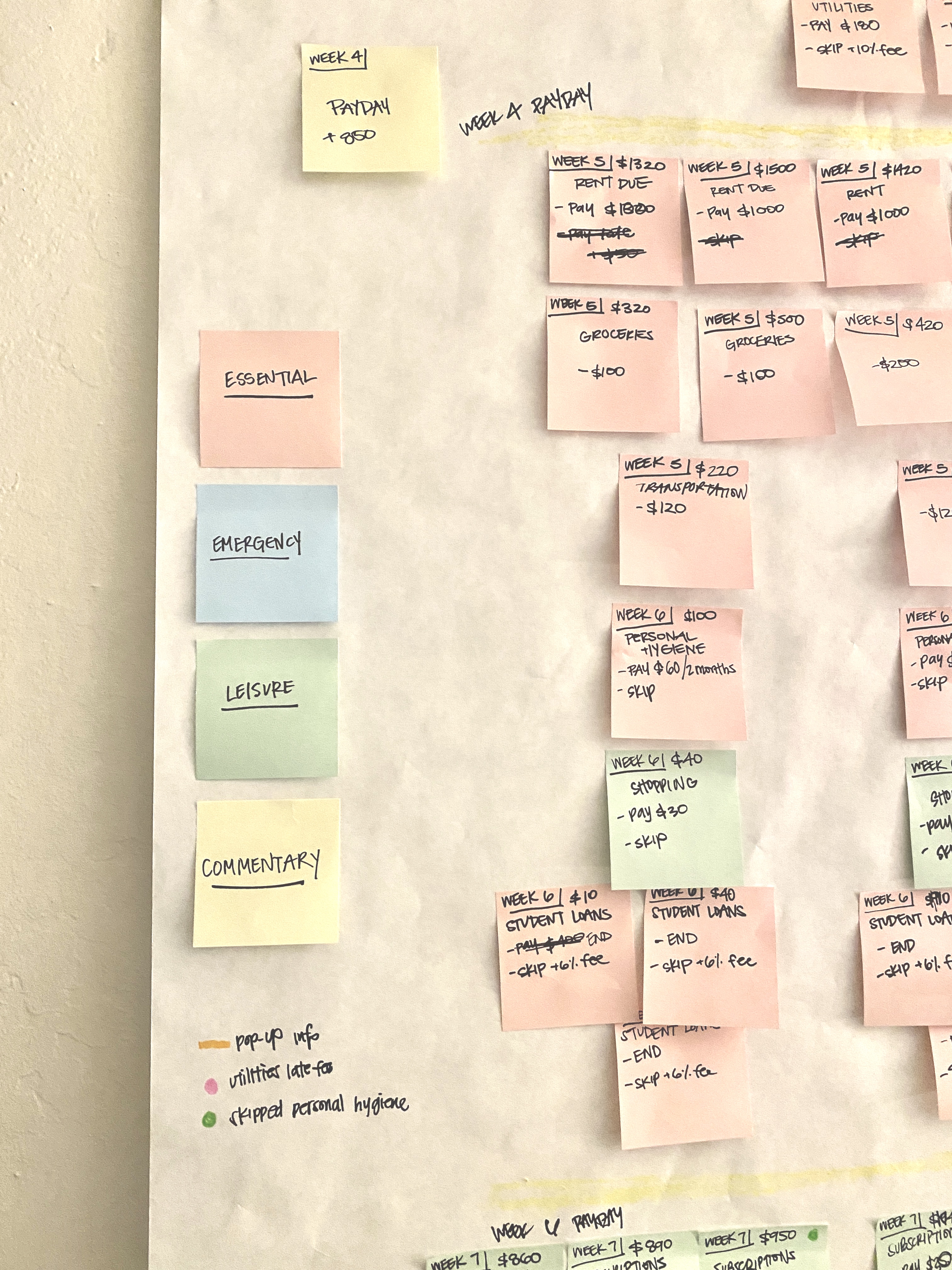

project goals —I wanted this project to be informative but also interactive to further encourage engagement and understanding of the experiences that many people go through. Engaging in a storyline would be more effective in showing the progression of money and paying for the necessities in life. Because people have different shopping habits, preferences, and necessities to some degree, many expenses were given price options or the option to defer payment until the next billing cycle, with penalty of course, just like real life. One of my biggest goals for this project was to really emphasize the experience of living paycheck to paycheck, sometimes waiting bi-weekly for your earnings doesn’t align with your billing cycle. As a reminder to the player, the game does not factor in expenses for leisure activities, rideshare services, or any external costs that are not mentioned in the game.

The secret: you cannot win. (That was the spoiler to this game). After calculating monthly expenses while planning this out, I realized that there was no way for this to be sustainable. I realized that no matter how much I tried to shave off of the expenses to try and give the player a good fighting chance, in the end you would eventually run out of money. And that was the point I was trying to make with this game: that though a $15 minimum wage sounds like a huge jump to many policy makers and constituents, it still isn’t enough.

The secret: you cannot win. (That was the spoiler to this game). After calculating monthly expenses while planning this out, I realized that there was no way for this to be sustainable. I realized that no matter how much I tried to shave off of the expenses to try and give the player a good fighting chance, in the end you would eventually run out of money. And that was the point I was trying to make with this game: that though a $15 minimum wage sounds like a huge jump to many policy makers and constituents, it still isn’t enough.

developing the game —

The game itself was completed in approximately 1 week. In order to create this interactive game, I had to map out every single outcome that could possibly result from each decision, as well as the filler pages that progress the story. This led to many different pathways created and in the end you can see how many different ways you can go broke!

The game itself was completed in approximately 1 week. In order to create this interactive game, I had to map out every single outcome that could possibly result from each decision, as well as the filler pages that progress the story. This led to many different pathways created and in the end you can see how many different ways you can go broke!

reflections and review —

I think this was a good start, though it is nowhere near what I wish it would be. This was completed in a short period of time at the very beginning of the covid-19 pandemic. I would love to make this more complicated and really get into the day to day experiences, though that may not be possible as a choose-your-own adventure game as that may move too slow. I would love for this to really highlight all the small and big decisions we must make when it comes to money. Another aspect I would love to incorporate are the different costs of living in the US, and the different employment opportunities associated with location. There are more nuanced decisions such as minimum payments that I did incorporate but minimally to limit the complexity but I wish that would be somehow implemented more into the game, to more accurately reflect the credit score system that Americans live with.

I think this was a good start, though it is nowhere near what I wish it would be. This was completed in a short period of time at the very beginning of the covid-19 pandemic. I would love to make this more complicated and really get into the day to day experiences, though that may not be possible as a choose-your-own adventure game as that may move too slow. I would love for this to really highlight all the small and big decisions we must make when it comes to money. Another aspect I would love to incorporate are the different costs of living in the US, and the different employment opportunities associated with location. There are more nuanced decisions such as minimum payments that I did incorporate but minimally to limit the complexity but I wish that would be somehow implemented more into the game, to more accurately reflect the credit score system that Americans live with.